Closing summary

Time to wrap up - here are today’s main stories.

Goodnight. GW

Rolling coverage of the latest economic and financial news

Earlier:

Time to wrap up - here are today’s main stories.

Goodnight. GW

Ryanair boss Michael O’Leary has warned that European airlines face a slump in Christmas and early summer travel as the spectre of another wave of lockdowns puts people off booking holidays.

“I think we’re in for a fraught period between now and Christmas where it looks like Europe is going to get very nervous again at the worst time of the year when people are making their Christmas travel plans,” he said.

“I think it’s inevitable we will undermine confidence between now and Christmas, and that will disrupt Christmas and New Year when they would normally start booking their summer holidays.”

More here:

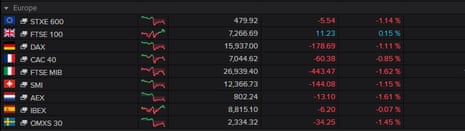

European stock markets have closed solidly in the red, as fears of further lockdowns this winter worry investors.

The pan-European Stoxx 600 index fell 1.3%, its fourth day of falls in a row from last week’s record highs.

The Netherlands’ AEX index shed 1.6%, with Germany’s DAX down 1.1%, as traders wondered whether new curbs could be introduced following Austria’s new lockdown this week.

The UK’s FTSE 100 bucked the trend, though, nudging up up 0.15%. Catering firm Compass led the risers, up 5.6% after reporting strong results.

Energy companies BP and Royal Dutch Shell also gained, as crude prices rose* after the US announced its release of oil stocks (* - which won’t please the White House)

Danni Hewson, AJ Bell financial analyst, sums up the session:

“It’s on a day like today that the FTSE 100’s global outlook really makes a difference to investor sentiment. Whilst concerns about rising COVID cases has wreaked havoc across European markets and with the UK’s more domestically focussed FTSE 250, London’s blue-chip index has remained stubbornly in positive territory. Miners helped keep things buoyant and there was a late surge from oil giants BP and Shell as markets digested President Biden’s moves and concluded they were perhaps more modest than had been anticipated; the price of a barrel of the black stuff rose slightly in reaction.

“Food service giant Compass was the day’s stand out performer as it dangled the carrot that dividends could be back on the menu. It was pummelled during the pandemic but has recovered remarkably well as restrictions relaxed and though revenues are still down the outlook has given investors something to chew over. At the other end of the scale the day hasn’t improved for AO World which warned profits would take a hit this Christmas because of the shortage of games consoles and iPhones.

“That plight is something that US retail giant Better Buy shares and its stock has tumbled after warnings about supply issues. The earnings update also delivered news that the rush to grab Christmas trade by starting Black Friday sales early had, unsurprisingly, hurt profits. What did surprise, and not in a good way, was an update from the CEO that a surge in organised crime had led the company to recruit more security guards. And it’s an issue that many retailers in the US and their staff are having to contend with, and one which could potentially get worse if prices keep going up and supply can’t keep up with demand.

“Generally, US markets struggled but it’s the tech heavy Nasdaq that’s taken the biggest hit today as bond yields rose and markets concluded that a rate rise might be closer today than it had been yesterday. Pandemic darling Zoom’s after hours update only confirmed expectation that a return to some kind of normal for many employees would hit growth. After months of virtual meetings people have been putting their trousers back on and chatting in person. And even though video conferencing will continue to have a major part to play in business and pleasure there are many more competitors nibbling away.”

British supermarket group Asda has appointed Stuart Rose, the former CEO of Marks & Spencer, as its new chairman.

Rose will take up the role on December 1st, said Asda, which is owned by the billionaire brothers Mohsin and Zuber Issa and their private equity partner TDR Capital.

Dame Alison Carnwath, the former Land Securities chair, is also joining as a non-executive director.

Lord Rose says appointing a new CEO for Asda is a priority, after chief executive Roger Burnley stepped down early in the summer following the Issa brothers’ £6.8bn takeover.

I am pleased to be joined on the Board by Dame Alison, who brings rigour and focus to everything she does – and look forward to confirming further non-executive appointments to our Board in the near future.

We are both excited at the prospect of working with Mohsin and Zuber and the wider Asda team as they look to build on Asda’s strong heritage of delivering affordable quality across food, fashion and general merchandise – and of championing customers at every turn. The process to appoint a new Chief Executive Officer for Asda, who has the vision to take this great business forward over the coming years, is a priority for the Board and we will be supporting the shareholders in this process.”

Asda has appointed former M&S boss Lord Rose as its new chair. Dame Alison Carnwath, who leads the audit committee at Issa brothers' EG Group, also joins as a non-exec

— Luke Tugby (@LukeTugby) November 23, 2021

Sky’s Mark Kleinman has an interesting take:

The move will be significant because the duo - who also served on the board of Land Securities together - are both directors of EG Group, the petrol stations giant.

EG’s founders, Mohsin Issa and his brother Zuber, jointly own both that business and Asda with TDR Capital, a London-based private equity firm.

The board appointments could spark speculation that a full merger of EG and Asda is a possibility, although that is not thought to be a short-term option for the shareholders.

Bank of England Governor Andrew Bailey has said he did not believe that stablecoins were likely to evolve into a form of safe, regulated money, leaving central bank digital currencies as a more likely future for electronic payments.

Bailey told lawmakers in the upper house of Britain’s parliament that “we have two choices” surrounding electronic payments:

“Is it going to evolve to some world of (asset-) backed stablecoins which has money-like features which could be regulated? I must say ... I am sceptical about that.

“Or ... is the better contribution, particularly to financial stability, to say the better alternative to that may be a central bank currency of digital form?”

Bailey is testifying to the House of Lords Economic Affairs Committee, as part of its inquiry into the future of digital payments (thanks to Reuters for the quotes).

Earlier this month, the BoE and the Treasury said they would hold a formal consultation next year on whether to move forward on a possible central bank digital currency (CBDC), although it wouldn’t be launched until the second half of this decade at the earliest.

Here are more highlights:

Andrew Bailey, Governor of the @bankofengland: “We’re seeing a very rapid growth, not so much in this country yet, but that’s probably a matter of time, of the crypto-asset world. The crypto-world is unbanked in terms of assets, it’s computer code.” #CBDC inquiry

— Lords Economic Affairs Committee (@LordsEconCom) November 23, 2021

“The latest estimate for crypto-assets now is $2.5 trillion. That’s around the market capitalisation of the FTSE 100. 95% of it is unbanked crypto-assets, and the other 5% is so-called Stablecoins, some of which are more stable than others.”

— Lords Economic Affairs Committee (@LordsEconCom) November 23, 2021

“That’s a very big growth which has happened very rapidly. We don’t regard it today as a direct financial stability issue, but we do regard it as having all the potential of become a threat to financial stability which is why we need to take action on that front.”

— Lords Economic Affairs Committee (@LordsEconCom) November 23, 2021

Deputy governor Sir John Cunliffe also spoke about the move towards digital money:

Sir Jon Cunliffe from the @bankofengland: “The Bank of England is going to continue to make cash available for as long as there is demand for it. We’re working closely with the Treasury on ensuring that there will be access to cash.” #CBDC inquiry

— Lords Economic Affairs Committee (@LordsEconCom) November 23, 2021

“The use of cash in transactions is declining sharply and has been so for the last few years. And Covid has accelerated that. Cash is now not usable for all transactions in the economy. 30% of transactions happen through Internet shopping and you can’t use cash for that.”

— Lords Economic Affairs Committee (@LordsEconCom) November 23, 2021

“As cash declines and becomes less useful for the way in which people live their lives in a digital economy should we replace it with a public asset, state money? Or should we depend entirely on the private sector to provide the money that is circulating in the economy?”

— Lords Economic Affairs Committee (@LordsEconCom) November 23, 2021

In the energy world, Bulb customers been reacting to the collapse of their energy supplier yesterday.

Some are dismayed, but a significant number also described how the quality of the firm’s customer service had fallen away in recent months.

Emma, a 32-year-old marketing executive from London, was unhappy at the news administrators had been appointed.

“I’ve been a Bulb customer for nearly four years and have always been incredibly impressed by their customer service and ease of use of their website and app … I dread being taken on by another provider now, as I know the customer experience won’t be as good.”

Rob, a 31-year-old researcher from Yorkshire, who had switched to the firm in part because it offered green electricity, was equally disappointed.

“I’ve always found Bulb to be very good. On the rare occasion I’ve needed to speak to them, customer services has been very good and issues have been resolved quickly.”

However, other readers reported doing battle with the company in recent months after it tried to up their direct debits, seemingly in an attempt to improve its cash position.

Clare, who described herself as an author, wrote:

“Ten days ago they contacted us to say our account was £17 in debit so they were doubling our monthly electricity payment to £230. There was no explanation, justification or right to appeal. I have so many friends whose payments were doubled in the past few weeks that it’s clear that Bulb was using customers as a cash-cow to make up for not being able to secure finance to stay afloat.”

More here:

Tax expert Richard Murphy, meanwhile, has been looking into Bulb’s accounts, which show how it made losses in 2019 and 2020, as its turnover and customer numbers grew.

He concludes that a company with such “a weak balance sheet”, even before recent wholesale energy price rises, shouldn’t have been allowed to grow so large (to become the UK’s 7th-largest supplier, with 1.7m customers.).

Murphy writes:

In itself this appeared to be a crisis that was always in the making.

And, yet again, it has to be said that accounting, accounting standards, accounting regulators, auditors and audit regulation have failed with the tab being picked up by society at large.

Murphy concludes that a persistent belief that markets can deliver better outcomes than any other supply mechanism runs though recent audit failures.

It is abundantly clear that this assumption is wrong, and not just with regard to energy, where Bulb is just the latest of many companies to fail, albeit that it is by some way the largest. That assumption also applies to the supplier of audit services.

Whether the market can now be relied upon to really deliver audit services of the quality that society needs is a question that has to be asked however uncomfortable that might make my own profession and this government feel. It would appear that the time for radical reform has arrived.

The failure of Bulb was predictable given the state of its 2020 accounts so why was it allowed to grow until it was too big to fail? https://t.co/5so4vpq5kb Bulb's accounts showed big losses and a technical insolvency in 2020 and yet the auditors did not express concern. Why?

— Richard Murphy (@RichardJMurphy) November 23, 2021

Here’s a full explanation of Bulb’s failure, from our energy correspondent Jillian Ambrose:

Back to Turkey, and the lira is still suffering a very severe tumble, down around 10% today at around 12.6 lira to the US dollar.

Brad Bechtel of investment bank Jefferies says the currency is in freefall, and thus likely to fall further:

The spark for the move seems to be Erdoğan’s speech in which he declared an ‘economic war of independence’ and praised recent interest rate cuts.

The central bank is a puppet of the government at the moment, inflation is running at 20% year-on-year and you have Erdoğan at the controls, which means that even at 12.75 we are likely not even close to done with this move yet.

The day that’s been coming for months has finally arrived, says Craig Erlam of trading firm OANDA:

Three large rate cuts, the prospect of another next month, a complete disregard for inflation and a spineless Governor that’s happy to be the President’s puppet on an issue in which he clearly has no experience.

The lira has “spiralled out of control”, and the time for desperate measures has finally arrived, Erlam adds:

Unfortunately for Governor Şahap Kavcıoğlu - although entirely deservedly - that will likely mean, either today or some point in the near future, being thrown under the bus.

This is the reality of Erdoğanomics and the results are there for all to see. Sky high inflation and a currency that’s fallen more than 30% against the dollar since the start of September. Another disastrous experiment at blurring the divide between poor politics and weak monetary policy.

Turkey's lira weakens 10%, trades at more than 12.5 to the dollar- Bloomberg #Turkey #Lira #Dollar #inflation pic.twitter.com/NkukP5qwhu

— XGLOBAL Markets (@xglobalmarkets) November 23, 2021

US retailer Best Buy has reported that organised theft is hitting its profits.

The American consumer electronics retailer posted a drop in gross profit margins for the last quarter, despite beating analyst estimates for third-quarter sales and profits.

Profit margins were hit, it says, by worsening organised retail crime, alongside a jump in promotional activity and costs associated with its new TotalTech membership program.

CNBC has more details:

Best Buy CEO Corie Barry said Tuesday that rising theft is hitting the company’s profits and could hurt employee retention at a time when the labor market is tight, especially in the retail industry.

She said the retailer has seen a noticeable jump in organized crime, with people coming to stores to steal consumer electronics — and in some cases, bringing a weapon like a gun or a crowbar. She said the company will prioritize the safety of customers and employees, even if that means criminals are running out of the door with thousands of dollars of merchandise.

“These are traumatic experiences and they are happening more and more across the country,” she said on CNBC’s “Squawk on the Street.”

Shares in Best Buy have tumbled by 17% in morning trading.

Theft is hurting Best Buy's profits. CEO Corie Barry says she's worried the crimes may cause employees to quit, too. $BBY

— Melissa Repko (@melissa_repko) November 23, 2021

“These are traumatic experiences and they are happening more and more across the country,” she said on @CNBC's @SquawkStreet.

https://t.co/8wFLimSx2N

Best Buy shares are tumbling the most since the start of the pandemic on Friday after the electronics retailer reported a drop in its gross margin, citing pressure from deeper discounts and more organized theft https://t.co/cBLLiwzDR8 via @business @bcase4bbg

— John J. Edwards III (@johnjedwards3) November 23, 2021

Over in New York, shares in videoconferencing company Zoom have tumbled by around 15% in early trading after it reported slowing sales growth last night.

After stunning growth early in the pandemic, Zoom may find it harder to maintain the pace as more people return to the office.

Mark Crouch, analyst at investment platform eToro, says:

“The pandemic transformed Zoom from a relatively obscure company in a niche area of the market into one that has become synonymous with business communications. Such was its breakneck growth that ‘to Zoom’ someone has become a widely accepted verb to describe video calling someone.

“However, the problem with runaway successes such as Zoom is that they eventually run out of steam. While the San Jose-based firm beat consensus earnings and revenue growth estimates for its fiscal third quarter, the firm has predicted a dramatic slowdown in growth.

“While revenue grew an impressive 35% year-on-year in Q4, that is significantly slower than the 54% growth reported in the previous quarter – and the firm predicts further slowing now that many companies have adopted its software and bought subscriptions.

Zoom shares gapping down -13% at the open. The earnings did not inspire. “Reopening headwinds”. Ugly news flow, ugly chart. Staying short. $ZM .@TheTerminal pic.twitter.com/m5OJwvLcka

— Edward (@markets1100) November 23, 2021

Zoom’s shares are now down almost 40% so far this year, but still around three times higher than in January 2020, before the first lockdowns.

The lira has recovered a little of its heavy losses, as Bloomberg reports that president Erdoğan has met with Turkey’s central bank chief.

They say:

Turkish President Recep Tayyip Erdogan has met central bank Governor Sahap Kavcioglu as the lira suffered a massive selloff and plunged to a new record low on Tuesday, according to an official with direct knowledge of the matter.

The official, who didn’t elaborate on what was discussed in the meeting, was speaking on condition of anonymity as it wasn’t officially announced. The bank and the presidency both declined to comment.

The latest collapse in the lira came after Erdogan defended his demands for lower borrowing costs that have driven up prices and frustrated investors.

They complain monetary policy is becoming increasingly irrational and unpredictable in a country where the president’s influence runs deep. While most central banks are talking of tightening policy as the global recovery fuels inflation, Turkey has slashed 4 percentage points off borrowing rates since September.

The lira is now trading at 12.5 to the US dollar, still down 9% today, on track for a record daily low.

Turkish President Erdogan met central bank Governor Sahap Kavcioglu as the lira suffered a massive selloff and plunged to a new record low https://t.co/4tiXApIM6z @markets aracılığıyla

— Kerim Karakaya (@kerimkarakaya34) November 23, 2021

Turkey’s lira crashed to a record low of 13.44 to the dollar on Tuesday, a level once unfathomable and well past what was just last week deemed the “psychological” barrier of 11 to the dollar.

“Insane where the lira is, but it’s a reflection of the insane monetary policy settings Turkey is currently operating under,” Tim Ash, senior emerging markets strategist at Bluebay Asset Management, said in a note in response to the news.

Turkish lira plummets to "insane" historic low after President Erdogan sparks sell-off https://t.co/JlOkpZSWRe

— CNBC (@CNBC) November 23, 2021

The Financial Times says the Turkish lira has “suffered a historic retreat” after President Recep Tayyip Erdoğan praised last week’s interest rate cut and declared that his country was fighting an “economic war of independence”.

The currency, which is down 45% against the dollar this year, plunged as much as 15% on Tuesday — a drop that eclipsed even Turkey’s currency crisis of 2018 — and broke through the symbolic threshold of 13 to the dollar after Erdogan used a combative speech to expound his vision for the country’s economy.

“It’s like a horror film,” said Enver Erkan, an analyst at the Istanbul-based Terra Investment, adding that it was hard to say how much further the currency would plunge given that policymakers appeared willing to simply let it fall.

“This is the inevitable consequence of Erdogan’s war on rates,” said Uday Patnaik, head of emerging market debt at Legal & General Investment Management.

“The thing that would stop the freefall is some sign of an independent central bank in Turkey. But there’s not much prospect of that. Erdogan’s the type of guy who likes to keep doubling down.”

The Turkish lira plunged 45% against the dollar this year -- and as much as 15% today -- after Erdogan praised a recent interest rate cut and declared that his country was fighting an “economic war of independence”. @laurapitel @TomStub https://t.co/cpKctQGJe4

— FT Europe (@ftbrussels) November 23, 2021

Comments (…)

Sign in or create your Guardian account to join the discussion